The starting point

Our client, a UK-based company, is a fast-growing digital platform at the intersection of e-commerce and blockchain, targeting consumers who value both convenience and innovation. However, traditional loyalty programs were losing their impact, failing to keep users engaged. And worse, they were becoming a magnet for fraud. Over the past two years, loyalty fraud surged by almost 31% in total fraud attempts, eroding both revenue and customer trust.

To address this issue, Mifort designed a next-generation loyalty solution built on blockchain. Unlike traditional databases that can be altered or manipulated, blockchain records every transaction as an immutable, time-stamped entry across a decentralized network. Each token transfer is traceable, irreversible, and cryptographically secured, making fraud, double spending, or reward abuse virtually impossible.

This foundation allowed us to merge the familiarity of loyalty programs with the power and flexibility of crypto tokens. Users receive something tangible and tradable, while businesses experience better engagement, smoother acquisition, and a significant win in transparency. Plus a shield against fraud.

Complexities behind the build

What the client wanted went way beyond writing good code. They needed a solution that was both simple and rewarding for users, while also being strong enough to scale and withstand real-world challenges, such as data transparency and fraud risks. It required vision, strategy, and the ability to merge both worlds. Our team identified several core challenges:

- Aligning consumer and business needs

It wasn’t enough for the platform to work. It had to be easy to use and make users feel like their time and effort were well worth it. Simultaneously, it had to provide measurable value and scalability for the business itself.

- Designing a secure and functional tokenized economy

A blockchain-driven internal token system had to be implemented. It needed to serve both as a loyalty currency and as a tradable crypto asset. Here, security was crucial as the architecture needed to minimize vulnerabilities and reduce opportunities for fraudulent behavior. Most importantly, user experience had to stay untouchable, without adding any friction.

- Building engaging token-mining mechanics

We had to take a special approach when designing reward tasks. Each task had to be both easy to understand and genuinely engaging, built around real user habits to encourage them to come back.

- Integrating a robust CRM system

The CRM had to do more than just track data in real time. It needed to simplify workflows and give teams an instant, transparent view of user activity and token movements to quickly adjust strategies. Most importantly, it had to give client early warnings of irregular patterns or potential abuse.

Strategic solutions we delivered

With years of fintech experience behind us, we transformed the client’s concept into a product that’s not only functional and easy for users to navigate, but also protects the business from fraud risks.

Here’s how we approached it:

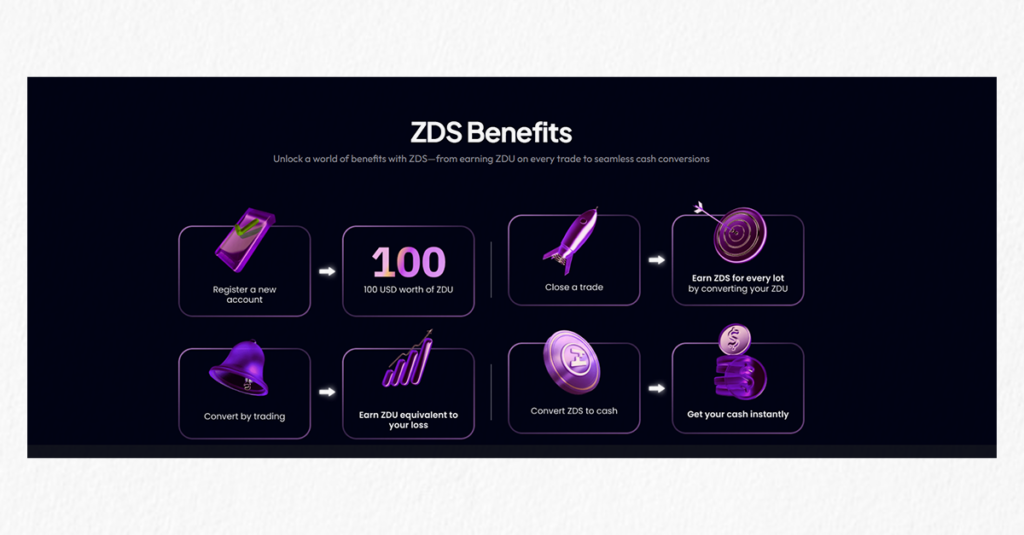

- Internal tokenized value system incorporation

We added a native crypto token that works both as a loyalty reward and as a tradable asset. Tokenization ensures every token has a unique identity, making it nearly impossible to counterfeit or duplicate. Combined with blockchain’s immutable ledger, this structure not only drives engagement but also cuts down fraud attempts by eliminating common weak points in conventional rewards programs.

Additionally, we built a token system that isn’t static. It’s tied to real activity and market signals. Users not only collect tokens as rewards but can trade them, which makes the platform feel more alive and valuable.

- Engaging token-mining mechanics

A segmented tier scheme was implemented, preventing abuse by ensuring rewards are linked to verifiable activity. It becomes more challenging for fraudsters to reach the highest tiers and redeem expensive rewards. Thus, it reduces the risk of fake accounts farming rewards.

We made sure rewards weren’t just about points. They had to feel exciting, keep users curious, for them to come back. With the customizable tiers, users had a reason to stay active, to be involved, and develop a sense of commitment.

As users progress through different reward levels, the platform collects detailed insights into their habits, preferences, and spending trends. This information enables precise segmentation and makes personalized, targeted marketing campaigns far more effective. As a result, this naturally led to better customer experience, marketing communication, retention and customer lifetime value.

- CRM & operational efficiency

We built a CRM that gives the team a clear, real-time view of how users interact with tokens and rewards. Beyond streamlining workflows and improving customer support, the blockchain-powered CRM creates a verified network of authentic user profiles. This approach significantly reduces fake accounts and fraudulent transactions, building a more secure and trustworthy platform environment.

- Dual-purpose feature integration

The component-based architecture we used lets rewards scale to match the needs of each user group. Whether someone is using the platform occasionally or every day, the experience feels personalized and worth their time.

Engineering the solution

Delivering a secure, high-performing, and scalable platform required a tech stack that could handle both blockchain workflows and modern web demands:

- .Net 6

Resilient and scalable backend- Vue.js

Dynamic, user-friendly frontend experience- Postman, Proxyman, and Swagger

API development, testing, and documentation- Apache Kafka

Seamless event streaming and data synchronization- BrowserStack and modern DevTools (Chrome, Safari, Firefox)

Cross-platform testing and optimization- Kibana, Grafana, and Prometheus

Monitoring, analytics, and real-time performance insights- Git and GitLab

Version control and CI/CD pipelines- DataGrip

Streamlined database management- TestGear

Automated testing, ensuring quality at every stepTangible results and impact

From day one, the platform started showing real, tangible results for the business:

- User growth and engagement

After the native token went live, registrations jumped as users were drawn to the chance of earning digital assets they could actually trade. The personalized rewards and token-mining tasks boosted user retention and kept engagement levels consistently high.

- Fraud reduction and operational gains

The CRM’s integration with blockchain analytics allowed real-time segmentation of users by: token balance, earning patterns, and trading activity. By using blockchain-verified engagement data, the platform removed the fraud issues that affected the old rewards system, cutting fraudulent accounts by 73%.

- Localized digital economy

The token found a new role in emerging markets. It now acts as a stand-in for traditional cash. Users could trade services or rewards using its crypto value.

Turning vision into market leadership

The collaboration with Mifort has laid the foundation for long-term growth, positioning the client’s platform as a reliable and innovative solution for the next generation of digital loyalty and crypto-powered engagement.